25/08/ · as far as i'm aware price movements in Forex generally occur because of some event in the outside world, whether it be a news announcement, election, storm, oil prices taking a hike or whatever. sometimes the events are very, very unpredictable. what also causes the market to move are technical factors.. the market may hit a very key level of support or resistance, at which point the price will often do something dramatic. and on occasions there are significant price moves 10/08/ · It is not a secret that the currency market has two distinctive patterns of movements: 1) Impulsive moves 2) Corrective moves. Impulsive Moves. The impulsive moves are 1 directional. These moves are fast and they tend to reach their targets in a quick timely fashion. These moves Estimated Reading Time: 8 mins equity or futures markets — including gauging interest-rate changes and eco-nomic releases — are also integral to forex trading. In addition, price moves in many commodities or indices are highly correlated to currency moves. For example, Australia is the world’s t h i rd - l a r gest gold pro d u c e r, which

What Moves the Forex Market the Most? An Analysis • Benzinga

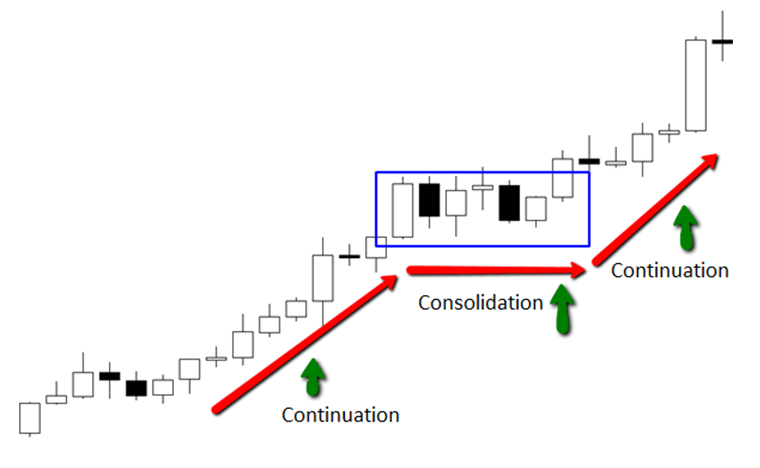

by TradingStrategyGuides Last updated May 11, All StrategiesForex Strategies 4 comments. This guide is all about a simple forex trading strategy using impulse moves. We are going to take some time to focus on impulsive and corrective moves as an attempt to explain the market behavior of a trading week. We will cover currency patterns, strategy implications, the trader's goal, and when impulsive moves start. The impulsive moves are 1 directional. These moves are fast and they tend to reach their targets in a quick timely fashion.

These moves rock and there is hardly anything stopping them. All support and resistance have vanished and the currency is moving endlessly in one direction.

The corrective moves have no clear direction, what moves the forex market. They bounce up and down, and down and up. There is no clear direction. In these areas we see the currency making flags, triangles, wedges, sideways consolidations, and much more corrective patterns. The net result is that the currency in fact hardly moves anywhere. It just oscillates back and forth. Forex trading is simple but not easy. That is why Trading Strategy Guides is here with valuable Forex advice day in day out on how to trade Forex.

These stats have important consequences. Also, read about Best Forex Indicators to Generate Buy and Sell Signals. Usually, speaking traders have Forex strategies that focus on either trend following setups impulsive or range-bound setups corrective. Some attempt to trade both but a high level of experience and great skill set is definitely required.

You can also read the article on how to check if your investment is backed by the right strategy. Impulsive moves, however, are kind of rare. Not as a rare as a peril. But still, it is obvious that the currency likes to correct. Roughly speaking, in 3 out of 4 cases the Forex market is in such a corrective mode, so it is definitely a substantial period of time.

Here you can read and get information on how to trade gold. A Forex trading strategy that incorporates this into the plan is pure gold. That is the best answer anyone can give to the question of how to trade the Forex market. This is not an easy task and requires a keen and experienced eye. However, there are areas in which a currency has a higher likelihood of making an impulse.

Trading with the trend, for example, increases those probabilities. This Forex strategy allows traders to focus on catching impulsive moves, as most of these moves occur in the same direction as the trend.

Of course, there are definitely impulsive corrections, just as there are trending movements that are slow-paced. If a trader is skillful enough to catch a corrective wave, then that is an added bonus. But until a trader is consistently profitable, sticking to impulsive trending mode trades is a wise idea, what moves the forex market. On average, corrections are by far less predictable than impulses.

Also, read trading discipline which is also a most important skill for successful trading. This is the most difficult question a trader can imagine. And the answer is not easy. However, here are some guidelines that can be used for identifying areas of corrections and areas of impulsive behavior, what moves the forex market.

The irony is that most traders try to chase an ongoing what moves the forex market. While this in itself might provide good opportunities for the experienced traders, for many traders this proves to be fatal. Many traders are lured into the market when seeing an impulse, what moves the forex market.

This in part can be explained by the psychological elements of fear and greed, what moves the forex market. Here is another article on the best technical indicators for forex trading. The trader sees action in the market and does not want to miss the boat with profit sailing away. Therefore the trader takes a leap of faith. Jumping into a rolling and ongoing move can, however, have adverse effects what moves the forex market sufficient preparations. In many cases the currencies retrace against the trader, just at the moment, the trader decides to take a trade.

How many of the readers recognize this phenomenon? Please write a comment in the section down below if you do. Because corrections are long and impulses are short, the statistical probability that the impulse will continue once it is on its way is decreasing. Once a correction has lasted a substantial period of time, the chances of an impulse occurring sometime soon are actually increasing.

This is almost the opposite of what seems natural to a trader. But the biggest reward can be achieved if a trader can catch the turnaround just before the impulsive move starts. There lies the biggest potential a trader can ever wish for. Use this knowledge wisely.

Here is an example of the GBPUSD during a past trading week. We hope that we have helped you with your quest on how to trade the Forex market. What have you noticed about your own impulsive moves and currency patterns? We specialize in teaching traders of all skill levels how to trade stocks, options, forex, what moves the forex market, cryptocurrencies, commodities, and more.

Our mission is to address the lack of good information for market traders and to simplify trading education by giving readers a detailed plan with step-by-step rules to follow. Because corrections are long and impulses are short, the statistical probability that the impulse will continue once it is on its way is decreasing.

Corrections are pretty common and happen in any market condition. Impulses is simply that many traders want to make a quick buck like during news events and get in and right back out. Hi Chris, Yes, I recognize myself when I was trading before joining the Mentoring Program.

What moves the forex market, always jumping on impulsive moves that just finished. Unable to recognize the repeated pattern of impulsive and corrective moves I was only chasing the market. Bad, very bad strategy. In fact I didn't have any strategy and just traded with emotions. Then Nathan talked to me about those Powerbars and this was the beginning of a complete switch in my trading.

Then, you, Chris, with this article, you explained very well how Forex moves and suddenly everything became crystal clear. Therefore, Nathan and Chris, another big thank you for this eyeopener! Cheers, Fabrice. Hi Fabrice!

That is great to hear! Very happy that this concept makes sense and it will certainly help us traders avoid chasing the market. This Friday there will be an article on that topic. Thanks so much for taking the time to write a post, much appreciated!!

Happy Trading! Please log in again. The login page will open in a new tab. After logging in you can close it and return to this page. Simple Forex Trading: Understanding Impulsive Moves by TradingStrategyGuides Last updated May 11, All StrategiesForex Strategies 4 comments. Currency Patterns It is not a secret that the currency market has what moves the forex market distinctive patterns of movements: 1 Impulsive moves 2 Corrective moves Impulsive Moves What moves the forex market impulsive moves are 1 directional.

Corrective Moves The corrective moves have no clear direction. For most traders, the best value for your money and your risk is catching impulsive moves. Impulsive moves have the following advantages: Impulsive moves reach their target quickly Impulsive moves what moves the forex market a better great reward to risk There are multiple advantages of having your trade develop quickly: The trade can be moved to break-even status quicker, allowing a trader to get back their margin.

This, in turn, gives a trader the opportunity to take a new trade. Also here you can learn about forex volume indicators. The trade will reach the target sooner, which lets the trading capital grow quicker.

Impulsive moves create less psychological stress with traders because the trade is good to go and on its way. In some cases, the trade could even be at the Break-Even level and all risk off the board, what moves the forex market. Trades that are open and indecisive for lengthy periods of time create insecurity with many a trader.

When Do Impulse Moves Start? The big question is: when do impulse moves actually start? Corrections Vs Impulses - Key Takeaways Because corrections are long and impulses are short, the statistical probability that the impulse will continue once it is on its way is decreasing, what moves the forex market. Thank you for sharing these articles, it is greatly appreciated.

How to Trade Forex like the Banks: Secrets Revealed! ����

, time: 17:55Price Action Guide to How the Forex Market Moves

25/08/ · as far as i'm aware price movements in Forex generally occur because of some event in the outside world, whether it be a news announcement, election, storm, oil prices taking a hike or whatever. sometimes the events are very, very unpredictable. what also causes the market to move are technical factors.. the market may hit a very key level of support or resistance, at which point the price will often do something dramatic. and on occasions there are significant price moves 10/08/ · It is not a secret that the currency market has two distinctive patterns of movements: 1) Impulsive moves 2) Corrective moves. Impulsive Moves. The impulsive moves are 1 directional. These moves are fast and they tend to reach their targets in a quick timely fashion. These moves Estimated Reading Time: 8 mins equity or futures markets — including gauging interest-rate changes and eco-nomic releases — are also integral to forex trading. In addition, price moves in many commodities or indices are highly correlated to currency moves. For example, Australia is the world’s t h i rd - l a r gest gold pro d u c e r, which

ไม่มีความคิดเห็น:

แสดงความคิดเห็น