28/11/ · 3) A momentum entry is when a Forex trader is waiting for a break of a (key) level. These entries are always waiting for the price to go through a tool drawn on the charts, such as a trend line. These traders are also called breakout traders. Here you can learn how to find opportunity in blogger.comted Reading Time: 10 mins 30/10/ · There are 2 ways to enter a trend: 1) early 2) late if the trend is obvious then you've entered late The first two arrows pointing to tops on the trend are black. These are the first two points used to draw a trend line. Now we would sit tight, and wait for price interaction at the third touch. The third arrow on the trend is blue. You will notice a strong bearish response off the trend blogger.comted Reading Time: 9 mins

Find Your Forex Entry Point: 3 Entry Strategies To Try

by TradingStrategyGuides Last updated Jul 12, All StrategiesForex BasicsForex Strategies 6 comments. Often I mention the importance of establishing whether there is a trend in play, or not. Logically when there is a trend in place, the trader has the opportunity to trade with the trend setups or countertrend reversal setups.

If the market is range-bound, then the trader would be best advised to deploy range trading tactics. Take a look at how to determine the best forex entry methods and the tools for entries. Obviously, it is vital for Forex traders to be able to recognize which environment the market is currently operating in so that they can employ the best-suited tactics and strategies at any particular time.

Some traders tend to specialize in one type of trading; others can successfully trade all different styles. In any case, when building your trading strategies it is wise to be aware of these factors:.

Read here more about how to build a trading strategy part 1 and part 2. Establishing the trend is an important factor for the above process. Using the classical definition of higher highs and higher lows versus lower lows and lower highs is the right step. But putting it all in practice on multiple time frames leaves a lot of space for interpretation. Having clear guidelines and rules is therefore very useful and important.

Basically, a crystal clear trend definition is worth gold, or in the case of the Forex trader: it how to enter a trend forex worth a lot of pips.

If yes, let me know down below and I will write an article next week on Friday defining the trend and how I approach the topic. Regardless of the type of trading strategies and market environment you seek to trade, the methods of establishing an entry point in the market can be classified or grouped together into 3 different categories. Here are the groups and classification of entries:.

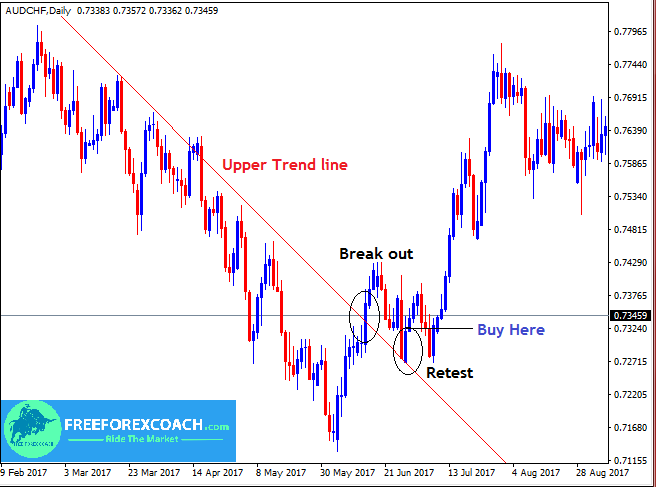

Irrespective of what the actual entry signal is, I do think that each and every one of them fits in one of the three groups mentioned above. The trader has the anticipation of a turn without any current evidence for that. The trader might, of course, have historical evidence that the entry methodology has proven to be successful but every new entry still remains to be seen. These entries are always how to enter a trend forex for the price to go through a tool drawn on the charts, such as a trend line.

These traders are also called breakout traders. Here you can learn how to find opportunities in Forex. Irrespective of the fact whether you are trading with the trend, counter-trends or ranges, all of us are still confronted with the choice of how to exactly enter the market. The paradigm Winners Edge Trading uses for its trading room is the following process:. Therefore once traders have completed the first three steps, all of us traders then need to decide how they want to enter the market.

In some cases, how to enter a trend forex, an opportunity for one group would be an entry for another. A momentum trader might consider a pullback as an opportunity but take the actual entry up to the break of a trend line, how to enter a trend forex, whereas the level picker might see use the pullback for an actual entry. There are some advantages and disadvantages when using the various entry signals. Most of them are quite straightforward and I am sure that there are many more elements, aspects, pros and cons than the ones I mention here below, so please mention those down below in the comment section!

An Early Entry: a Suitable for long-term position traders that are aiming for larger swings in the market. b Less problematic to identify exact entry but in cases with tops and bottoms, more difficult to use. An optimal stop-loss position, in cases with Fibs stop loss is clear. c Suitable for traders who want to monitor price action development less intensely. d There is a higher risk for that trade due to no evidence of turn and trade probabilities tend to be lower, which needs to be offset by the higher reward to risk.

e The trade takes longer to develop compared to the other 2 groups. A Confirmation Entry: a. Traders can await the reaction of the market to the desired level, which for some traders might make it easier to take a trade.

The confirmation has the danger of turning out to be small but the price, however, how to enter a trend forex, continues in the same direction the confirmation turned out to be a small pullback for a continuation of the momentum opposite of the direction wanted. The entry and stop losses are easily defined. A Momentum Entry: a. Suitable for traders who want to optimize their entry point and clear stop loss level. Suitable for traders who are very active in the market. These entries have a higher chance of skipping sideways price action and catching the faster impulsive part of the move, which means that the trade usually is shorter d.

Danger of trading false breakouts and getting whipsaws. Exact entries and stop-loss levels depend on where the break occurs. Some traders choose 2 or all of the above entry styles, which does give the opportunity for a trader to scale in and scale-out.

Scaling in and out is a great technique to maximize the profits when a trader is winning and minimize the losses when the trader is losing. The practical implementation of the technique, however, is not as easy as it might sound.

A good tip for making this part of the trading easier is by treating every single entry as a separate analysis but with one risk management plan. Here is an example: regardless of the fact that your early entry is ahead a certain amount of pips, you want to make sure that the confirmation or momentum entry qualifies as a legitimate entry even if you did not have the early entry which was making pips and that there is sufficient space within your risk management parameters.

Also, read about Scaling in and Scaling out in Forex. The entry preference will vary for every trader, depending on their trading style and trading psychology. Some traders might not be able to handle early entries that well as they rather wait for a momentum break. Others might find it easier to trade a pullback as they are able to plan the trade more ahead of time.

Your trading how to enter a trend forex and trading psychology are important factors that influence this choice, so those are elements that everyone will need to take into account for their own trading.

Despite the individual traits, there are some common elements that all entries how to enter a trend forex. Here is the table:. When a trend is in place, most entry possibilities are deemed desirable. The difference between good and perfect is a personal choice and up for debate.

However, the advantage of waiting for confirmation and momentum in a trend is that there is more clear guidance when a corrective pullback is over and has finished, how to enter a trend forex. In a range environmentthe best entry to use is how to enter a trend forex early one. Waiting for momentum or confirmation can be ok if the range is wide enough and has sufficient space for a trade to develop with a decent reward to risk ratio.

If the range is too small, the latter two entries are not desirable. With counter-trend tradingit is important to note that generally speaking this how to enter a trend forex of trading is considered to be more difficult.

If you do want to trade counter-trend, how to enter a trend forex, then trading it with an early entry signal does provide the best prospects for both a reversal and a retracement. But once again, catching a reversal is difficult.

A confirmation entry is ok if a trader is expecting a reversal, but if the market is only making a retracement then the confirmation entry might happen right at the turning spot for more trend continuation. Momentum entries are definitely not advisable for counter-trend trades. Top of the mountain: At the top of the mountain a trader is very lonely, as he is the only one thinking that price could go down, whereas the majority of the traders are in the valley thinking how far can the price go up.

Nobody knows yet where the peak of the mountain price will be but the early entry trader makes a decision and goes for a certain level. If all goes well, his entry is right at the peak. A third away from top: The confirmation entry is about a third away from the top. These traders have been price hit the top and move down away from it and are trying to ride the trade back down to the valley.

Close to Valley: Momentum traders are waiting for the price to move how to enter a trend forex lower and pick up speed when the price is rolling down the slopes. It jumps on board when the price has a good speed and angle and is trying to catch the last but fast roll down into the valley, after which prices bottom out and due to its velocity rolls out and up the next hill retracement.

Regardless of your trading strategy, you should only take a trade entry if it passes this 3-step test:, how to enter a trend forex. A forex entry point is a price at which a trader buys or sells a currency pair. There how to enter a trend forex various entry techniques used in forex trading which includes breakout entries, support and resistance entries, overbought and oversold entries, divergence entries, etc.

When it comes to entering and exiting the market, price action and technical analysis are the most common tools used by traders to help them time how to enter a trend forex market. The entry price represents the price at which traders buy and sell securities.

The how to enter a trend forex your entries are, the bigger the potential profit is. For short-term traders, the entry price is more critical than for long-term traders. Day trading requires entering and exiting a position within the same trading day. To enter and exit the market, day traders will use charts and technical analysis to identify buy and sell trading signals.

In any case, whatever entry method you decide to use, it is always important to plan the trade ahead and wait for those market circumstances to emerge. Stop chasing the market is the motto. More information on that can be found in this article. This wraps the article on entries. Make sure to look at the article on stop losses and take profits as well. We recommend you follow up with our articles about the factor of time as well, you can find both parts here: part 1 and part 2.

We specialize in teaching traders of all skill levels how to trade stocks, options, forex, cryptocurrencies, commodities, and more. Our mission is to address the lack of good information for market traders and to simplify trading education by giving readers a detailed plan with step-by-step rules to follow.

Great write-up, Chris! Very detailed on entry categories, entry tools for per category and the pros and cons of each entry style. Great stuff! Many thans, Chris! Please log in again. The login page will open in a new tab.

ANYONE CAN TRADE FOREX (A Very EASY Entry Technique)

, time: 11:27Forex Trendline Trading System (AGGRESSIVE ENTRY METHOD)

28/11/ · 3) A momentum entry is when a Forex trader is waiting for a break of a (key) level. These entries are always waiting for the price to go through a tool drawn on the charts, such as a trend line. These traders are also called breakout traders. Here you can learn how to find opportunity in blogger.comted Reading Time: 10 mins The first two arrows pointing to tops on the trend are black. These are the first two points used to draw a trend line. Now we would sit tight, and wait for price interaction at the third touch. The third arrow on the trend is blue. You will notice a strong bearish response off the trend blogger.comted Reading Time: 9 mins 23/10/ · Candlestick patterns are powerful tools used by traders to look for entry points and signals for forex. Patterns such as the engulfing and the shooting star are frequently used by experienced Estimated Reading Time: 4 mins

ไม่มีความคิดเห็น:

แสดงความคิดเห็น