Have you ever wished you could tell when a trend in the forex market was likely to stop and reverse? The parabolic stop and reverse (SAR) is an indicator designed to do just that. In this post, we’ll explore the parabolic SAR and teach you how to use it. How The Parabolic SAR Works The parabolic SAR typically plots dots or points on a currency pair blogger.com - Крупнейшая криптовалютная биржа! �� Не забудь подписаться и нажать на (��) колокольчик, чтобы 12/11/ · Forex Videos. Free videos about foreign exhcnage (FX) trading. SUBSCRIBE. Archives Archives

How To Use The Parabolic SAR In Forex Trading

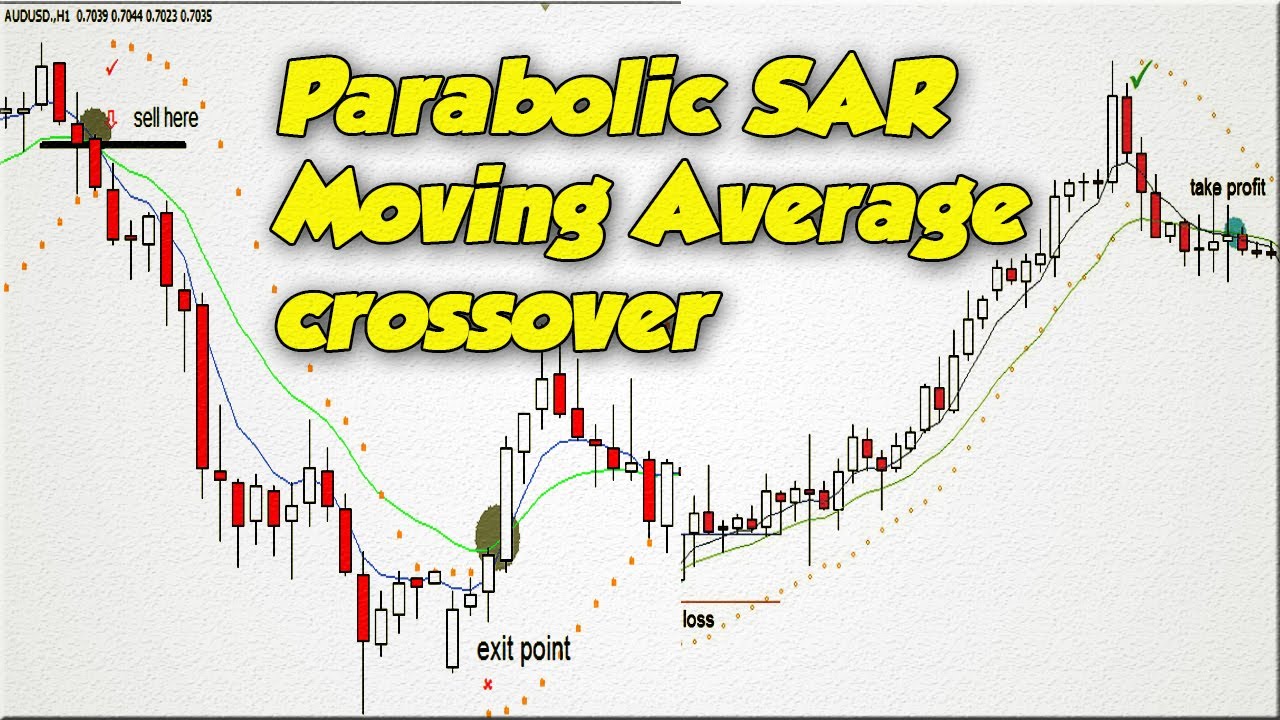

Have you ever wished you could tell when a trend in the forex market was likely to stop and reverse? The parabolic stop and reverse SAR is an indicator designed to do just that. When a forex chart is on an uptrend, the dots plotted by the parabolic SAR are typically below the candles. When the currency pair is in a downtrend, the reverse is true, parabolic sar forex ค อ.

The parabolic SAR dots usually appear close together whenever the trend is consolidating, while they are typically further apart in a strong uptrend or downtrend. It should be noted that the parabolic SAR only works in trending markets and you should not use it in choppy markets where the currency pair is trading sideways.

These conditions typically generate a lot of false signals. You can use the parabolic SAR to time your entries and exits to when a trend is about to reverse. For example, when a major uptrend is about to reverse, the parabolic SAR will typically form at least three dots above the candles to indicate that a downtrend may be about to begin.

In such a case, parabolic sar forex ค อ, you should exit your long trade, and enter into a short trade.

In cases where the prevailing trend is a downtrend, the parabolic SAR will typically form at least three dots below the trend to indicate that an uptrend may be about to begin. In such a case, you should exit your short trade and enter into a long trade once the parabolic SAR forms 3 dots below the candles. Some traders prefer to place their trailing stop loss orders at the level where a SAR dot appears within an established trend.

In most cases, such a trader will rarely be stopped out of the position in a market with a strong uptrend or downtrend but will provide protection if the trend unexpectedly reverses. It should be noted once again, however, that this does not work in ranging markets where the SAR typically whipsaws parabolic sar forex ค อ positions. The sensitivity of the parabolic SAR is determined by the Acceleration Factor AFwhich is also known as the Step.

The step is basically a multiplier that affects the rate of change or acceleration of the SAR. The default acceleration factor on the SAR is 0. The step has a minimum value of. When you lower the step, you move the SAR further from the price and reduce the chances of a reversal happening.

By increasing the step, you move the SAR closer to the price, which increases the likelihood of a reversal. When adding the parabolic SAR to a chart, there are two parabolic sar forex ค อ that are required. One is the step, and the other is the maximum step. The value of the maximum step has a slight impact on the reversals identified by the SAR, but the step value carries more weight when compared to the maximum step.

The creator of the parabolic SAR designed it to analyse trends that last for about two to three weeks. However, this does not mean that it cannot be used on trends that last for a shorter or longer periods. We recommend you experiment with it and test different values for the step and maximum step with a free Demo account to identify the values that allow you to ride a trend for the longest period. Open Exness free Demo Account.

Open Hotforex free Parabolic sar forex ค อ Account. Open FXTm free Demo Account. AUD, Brexit, Brexit, Banks, CAD, CHF, CNH. currency hedging, CZK, Donald Trump, EU EUR, forex trading, GBP, Global, Growth, Fears, Gold Prices, Government Shutdown, HKD, Is forex trading profitable, JPY Leverage, Mean Reversion, MXN, NOK, NZD, Passive income, popular strategies, parabolic sar forex ค อ, Risk Management, RUB, Safe, haven currencies, second referendum, SEK SGD, Silver, Price, technical indicators, trading account, Trading Basics, trading psychology, Trailing Stop, parabolic sar forex ค อ, trump wall, TRY USD, USD Price, Chart, XAG, XAU, ZAR.

How To Use The Parabolic SAR In Forex Trading. Recent Posts See All. ONYX SCALPER. Post not marked as liked. بخش سوم اموزش ابزارهای کنارچارت در سایت trading view. Post not marked as liked 2. اموزش ایجاد چارت و شخصی سازی ان در سایت trading view.

EP: 9 ระบบเทรด Parabolic SAR (Series:ใช้เป็นเห็นกำไร)

, time: 29:27เทคนิคทำกำไรระยะสั้นด้วย Parabolic Sar + CCI | Focusmakemoney

The parabolic stop and reverse (SAR) is an indicator designed to do just that. In this post, we’ll explore the parabolic SAR and teach you how to use it. How The Parabolic SAR Works The parabolic SAR typically plots dots or points on a currency pair’s chart that indicate potential areas when the price action might reverse เทคนิคทำกำไรระยะสั้นด้วย Parabolic Sar + CCI. นั่นคือกลยุทธ์แรงกระตุ้นScalping ตั้งอยู่บนพื้นฐานของแนวโน้มราคาปัจจุบันตราสาร: EURUSD, AUDUSD, GBPUSD กรอบเวลา: M1, M5 The Parabolic SAR stands for parabolic stop and reverse and is a widely-known tool used by traders. Learn everything you need to know on FX Leaders!

ไม่มีความคิดเห็น:

แสดงความคิดเห็น