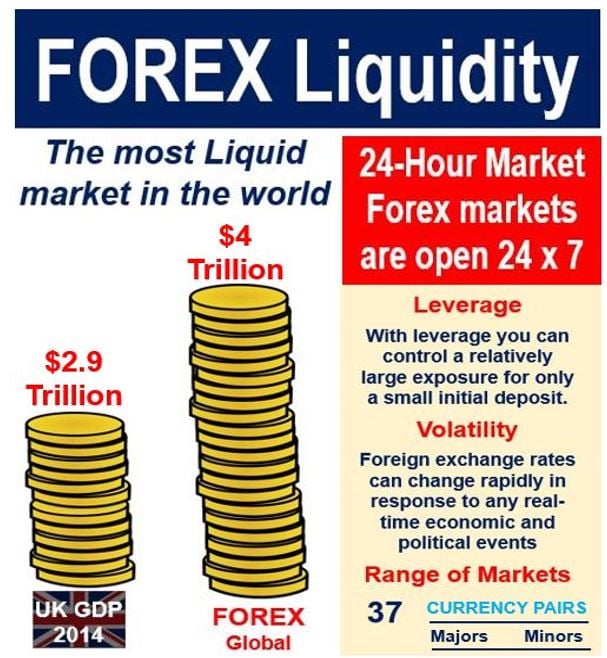

In simple words, forex liquidity shows h ow much money circulates in forex. High liquidity implies a significant level of trading activity and high supply and demand for an asset. The definition of forex liquidity is quite similar to that of general liquidity 11/12/ · The second most liquid forex pair is USD/JPY, with a share of 13%. The third most liquid pair is GBP/USD (11%). Information on further currency pairs can be found in the chart above. Of course, there are other a lot of other pairs, mainly exotic ones, but nobody knows which one of them is the least liquid. They probably have no liquidity at all Estimated Reading Time: 3 mins 01/09/ · High liquidity in the forex market means that you can purchase and sell your pair in significant sizes without moving the market too much in either direction. However, it will depend on the currency exchange rate and the amount you are trading

Tight spreads. High liquidity. Instant execution – Forex for Beginners

Liquidity is an important factor for a financial market. No matter how wealthy you and your country are, you may lose all your money if you do not have enough liquidity or liquid assets. You must have heard about the lack of liquidity in the market during financial crises. Many companies also declare themselves bankrupt when they do not liquid assets to pay off their clients.

Like all other financial markets, liquidity is a key factor for forex trading. The forex market offers very high liquidity over other markets.

Forex traders also take advantage of this liquidity as and when they start. Forex liquidity allows a trader to trade easily and make forex a popular market, high liquidity forex. This article will explain to you the importance of liquidity and an overall high liquidity forex of how liquidity affects forex trading.

Liquidity refers to the active status of the market. It means how many traders and how much volume is being traded in the market at a particular time.

When the pandemic started, and all the governments made use of masks mandatory, there was a high demand for masks in the market. As a result, many companies started working on the production of surgical masks. Soon, the demand and supply of the masks were high. People were easily buying and selling masks. That means the surgical masks market was highly liquid. So, this example shows how much a product was in demand in the market.

This is the market liquidity. When the demand and supply of a product and service are higher in the market, you can buy or sell your things in no time. In the financial market, liquidity means how quickly and easily you can convert your financial assets into physical or electronic cash. Some instruments are quite liquid and can be easily bought and sold in the market, high liquidity forex, for example, gold or US bonds.

On the other hand, some are less liquid. It means that there are high liquidity forex buyers for them in the market for example - Greek bonds. You cannot sell or exchange them for any other instrument in the market.

Liquidity in the forex market refers to the ease with which you can buy or sell a currency pair without creating a major impact on the exchange rate. If for a currency pair, there is a good amount of trading activity, and you can buy and sell them easily, it means that the currency pair is highly liquid. On the other hand, the currency pair with less trading activity will be less liquid. The forex market is considered to be one of the most liquid markets when compared to other financial markets.

It is mainly because of two reasons. Firstly, high liquidity forex, you can trade in this market 24 hours a day for seven days. At any point of time, there is a high amount of forex trading going on in this market. Read Also: How to Start Making a Profit With Forex Trading. If you trade in a liquid currency pair, high liquidity forex, you will surely get its unsaid benefits. However, if you trade in a currency pair based on its availability in the market, your trade will depend on the liquidity of the financial institution.

This liquidity will help you keep in and out of the trade. Currency pairs in a forex market have varying levels of liquidity. The liquidity depends on whether a currency pair is a major, minor, or exotic one.

As a trader move from major to minor or towards an exotic pairforex liquidity tends to dry up, high liquidity forex. High liquidity in the forex market means that you can purchase and sell your pair in significant sizes without moving the market too much in either direction.

However, high liquidity forex, it will depend on the currency exchange rate and the amount you are trading. Major currency pairs are highly liquid. Some of them are:, high liquidity forex.

Alternatively, low liquidity means that you cannot buy or sell a currency pair in significant sizes without creating an impact on its exchange rate. For currency pairs with low liquidity, there are chaotic and random moves in the market. Don't Miss: The 5 Most Traded Currency Pairs. Any market broker or institution who works as a professional market maker from both ends of a currency transaction is a liquidity broker.

Several market participants increase forex liquidity volume, high liquidity forex. In an illiquid market, trading volume will vary at any moment of the day. On the other hand, liquid market also known as deep or smooth market the price action is smooth. For a forex trader, good liquidity is quite important because you cannot manage risks that come with the illiquid market. There are certain strategies that traders can use to gauge the liquidity in the forex market.

You can trade in a forex market for 24 hours a day. You can easily enter and exit from the forex at any time of the day. Thus, a forex market does not have too many price gaps. Alternatively, the markets, that work only for some hours in a day tend to show price gaps due to some unwanted and unpredicted announcements made overnight. However, any unexpected news announcement or any change in the interest rate can bring price gaps in forex.

The overall gaps in forex are generally less than 0. Liquidity providers do not want to risk their positions over news releases and thus, do not indulge in trade. This leads to sharp price hikes in both directions. Though the forex market is open 24 hours a day, it does not high liquidity forex that you will see the same level of liquidity throughout the day. Some high liquidity forex of the day show high liquidity in forex while at other times, it dips.

As a short-term trader, you must know when the forex market is most liquid. Almost all currencies trade in the forex market and thus, it is highly anticipated. The forex market is generally divided into different sessions into different zones based high liquidity forex the start of operations at their high liquidity forex centres.

Every session has its level of liquidity. Once the US afternoon session begins, you will see high liquidity forex drop in the trade volume.

However, some surprise announcements made by Federal Open Market Committee FOMC can prevent these drops in the afternoon. But it is only a few times a year. Apart from these, the Asian session is less active and less liquid. This is because the support and resistance are directly controlled by speculations. Check Out: The Best Forex Trading Hours, high liquidity forex. At the end of the summer or before the New Year holidays, there is a decline in the trading activity.

It is the time when only a few buyers and sellers are left in the market. Thus, the price movements are larger than normal. This situation is characterized by high price volatility and low liquidity. Large and experienced forex traders take advantage of these weak points to achieve major key levels.

As high liquidity forex is low, overall transactions are higher making the spreads wider. Though forex liquidity is mostly rewarding, it brings risks as well. The major example of liquidity risk is that of the High liquidity forex Franc crisis that occurred in the year Thus, as a forex trader, you must know how to manage your liquidity risk.

To manage liquidity risk, you can lower your leverage that will reduce your losses but profit also. On the other hand, you can manage this liquidity risk with the use of guaranteed stops. It means you create a stop loss at your order so that your position is closed at a pre-determined price level.

Guaranteed stops are generally not affected by market volatility. Always weigh your options between liquidity risk and reward to be in the best position, high liquidity forex. What Type of Forex Trader You Are? What Are The Easiest Currency Pairs To Trade?

Top Chart Patterns Every Trader Should Understand. How To Calculate Your Risk While Trading. The Benefits of Forex Trading, high liquidity forex. How Difficult is Forex Trading? Forex Trading Articles. Trade Forex Now. Last Updated September 1st What Is Liquidity? What Is Liquidity In The Forex Market? Read Also: How to Start Making a Profit With Forex Trading Importance Of Liquidity In Forex Trading If you trade in a liquid currency pair, you will surely get its unsaid benefits. Liquidity decides how quickly and easily you can open and close a position.

Liquidity reduces risks as buyers and sellers are always available in the market.

FOREX INSIGHTS: What is Liquidity and how it works in any trading environment.

, time: 6:06Forex Liquidity | Myfxbook

11/12/ · The second most liquid forex pair is USD/JPY, with a share of 13%. The third most liquid pair is GBP/USD (11%). Information on further currency pairs can be found in the chart above. Of course, there are other a lot of other pairs, mainly exotic ones, but nobody knows which one of them is the least liquid. They probably have no liquidity at all Estimated Reading Time: 3 mins In simple words, forex liquidity shows h ow much money circulates in forex. High liquidity implies a significant level of trading activity and high supply and demand for an asset. The definition of forex liquidity is quite similar to that of general liquidity Lower liquidity usually results in a more volatile market and cause prices to change drastically; higher liquidity usually creates a less volatile market in which prices don’t fluctuate as drastically. Liquid markets such as forex tend to move in smaller increments because their high liquidity results in

ไม่มีความคิดเห็น:

แสดงความคิดเห็น