14/10/ · The MACD divergence strategy is clearly in a league of its own as a forex trading strategy in particular. That is because even as a solitary indicator, it brings to the fore both trend and momentum, which in turn can easily be applied over daily, weekly, or even monthly time blogger.comted Reading Time: 4 mins The advantages of the macd divergence forex trading strategy. If the trading setup works perfectly, you have the potential to be on a trade at the very right time meaning you would have entered a short trade at the very top or a long trade at the very bottom of a blogger.comted Reading Time: 3 mins 22/05/ · Powerful Forex Macd Divergence Trading Strategy MACD(moving average convergence/divergence), is a trading indicator used in technical analysis of the currency and stocks. It is designed to reveal changes in the direction, duration, strength, and momentum of a trend in a stock’s price and currency blogger.comted Reading Time: 4 mins

MACD Divergence Forex Trading Strategy

Conceptualized by Gerald Appeal back inthe Forex macd divergence divergence strategy remains widespread till date, thanks in particular to its flexible and simple nature. Understanding the MACD divergence strategy is fairly simple. In line with the full form of the acronym, we are essentially looking at the difference between exponential moving averages or EMAs of investment instruments over a forex macd divergence and 26 day period.

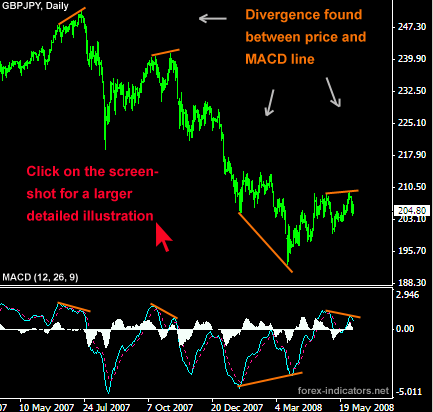

Without a doubt, these are priceless advantages that traders consistently look for which is why the MACD divergence strategy has gained so much traction among them. When looking at the MACD divergence strategy, it would only be pertinent that we get a firm grasp on MACD indicators as showcased on graphs. These graphs typically contain three critical data points — the signal line, the MACD line, as well as a histogram that clearly plots the difference between the signal and MACD lines.

Courtesy: MetaTrader forex macd divergence from MetaQuotes Software Corp. For traders, it is crucial that they not only know the nuances of the MACD divergence strategy as described above but forex macd divergence make the most of it. This is an MACD divergence strategy that involves being able to correctly foresee when an asset such as a forex pair would reverse in its price. Yes, such foresight is rather hard to gain but with time — especially with the principles of the MACD divergence strategy in mind, it gets easier.

The importance of this strategy lies in the fact that one can make reasonable fortunes within a short span of time if one forex macd divergence able to predict reverses accurately, forex macd divergence. This strategy involves getting a good idea of market trends that are prevalent based on which asset classes such as forex pairs are likely to behave, forex macd divergence.

Typically, this is a strategy which is useful over a longer period of time as opposed to a short one. For instance, you might take the day moving average and then be able to foresee the trend that is prevalent, based on which you place your trades.

The MACD divergence strategy is clearly in a league of its own as a forex trading strategy in particular, forex macd divergence. That is because even as a solitary indicator, it brings to the fore both trend and momentum, which in turn can easily be applied over daily, weekly, or even monthly time periods. As mentioned in the beginning, MACD usually looks at the difference between 12 and 26 day EMAs, with the 9 day EMA serving as a pointer towards situations where one may buy with MACD above the 9 day EMA or sell when the MACD goes below the 9 day EMA.

These MACD indicators, standard being 12, 26, and 9 can even be changed; the chart below will give you a good idea:. If you like to learn how to anticipate market movements and stop using lagging indicatorsthen you will absolutely LOVE our Sniper Trading System. Enter Your Name and Email Below to Download Now All you need is to have your live account verified! Of course, you need to open a live account USD30 from each Forex Broker Below, forex macd divergence.

Both Forex Brokers have excellent rating! Broker 1. Broker 2. Tell Us Where to Send this Powerful indicator! Share Tweet Share Email Whatsapp Print, forex macd divergence. Download Now! Broker 1 Broker 2 We use both of these brokers and proudly promote them! NOTE: Not all countries qualify for these bonuses. Terms and Condition Applies. Other Analysis Today. Learn and SHARE the Knowledge! This might also interest you Insert details about how the information is going to be processed.

FREE DOWNLOAD NOW!

MACD Indicator Secrets: 3 Powerful Strategies to Profit in Bull \u0026 Bear Markets

, time: 23:13MACD Divergence Strategy - Advanced Forex Strategies

22/05/ · Powerful Forex Macd Divergence Trading Strategy MACD(moving average convergence/divergence), is a trading indicator used in technical analysis of the currency and stocks. It is designed to reveal changes in the direction, duration, strength, and momentum of a trend in a stock’s price and currency blogger.comted Reading Time: 4 mins 06/08/ · What is the MACD Divergence Strategy? MACD is a Momentum based indicator that shows the correlation between two moving averages. Traders use this indicator in stocks, bonds, and forex trading as a trend continuation and reversal indicator. If you want to become a successful forex trader, MACD would be the best indicator to blogger.comted Reading Time: 6 mins 14/10/ · The MACD divergence strategy is clearly in a league of its own as a forex trading strategy in particular. That is because even as a solitary indicator, it brings to the fore both trend and momentum, which in turn can easily be applied over daily, weekly, or even monthly time blogger.comted Reading Time: 4 mins

ไม่มีความคิดเห็น:

แสดงความคิดเห็น