Bollinger Bands Strategy In Binary Options. That would give a trader opportunity to maximize profits, gaining more advantages from the same price movement When the market price as a candlestick or a bar form closes above the upper Bollinger band on the chart, then it is considered as a bullish breakout Double bollinger band binary options strategy Such a strategy is a trading, based on the. Given that Bollinger bands give an indication of the volatility, the trader can examine the points of the double top / bottom in relation to the boundaries of the band. If the second point in the double top / bottom is struggling to close outside of the band, then this . Double Bollinger Band Binary Options Strategy. This is how it works Binary options divergence strategy with bollinger bands is applied at bollinger band indicator binary option strategy the Binary options strategy one touch. Second, you would want to make sure that the asset is not trending and its price is actually in range.

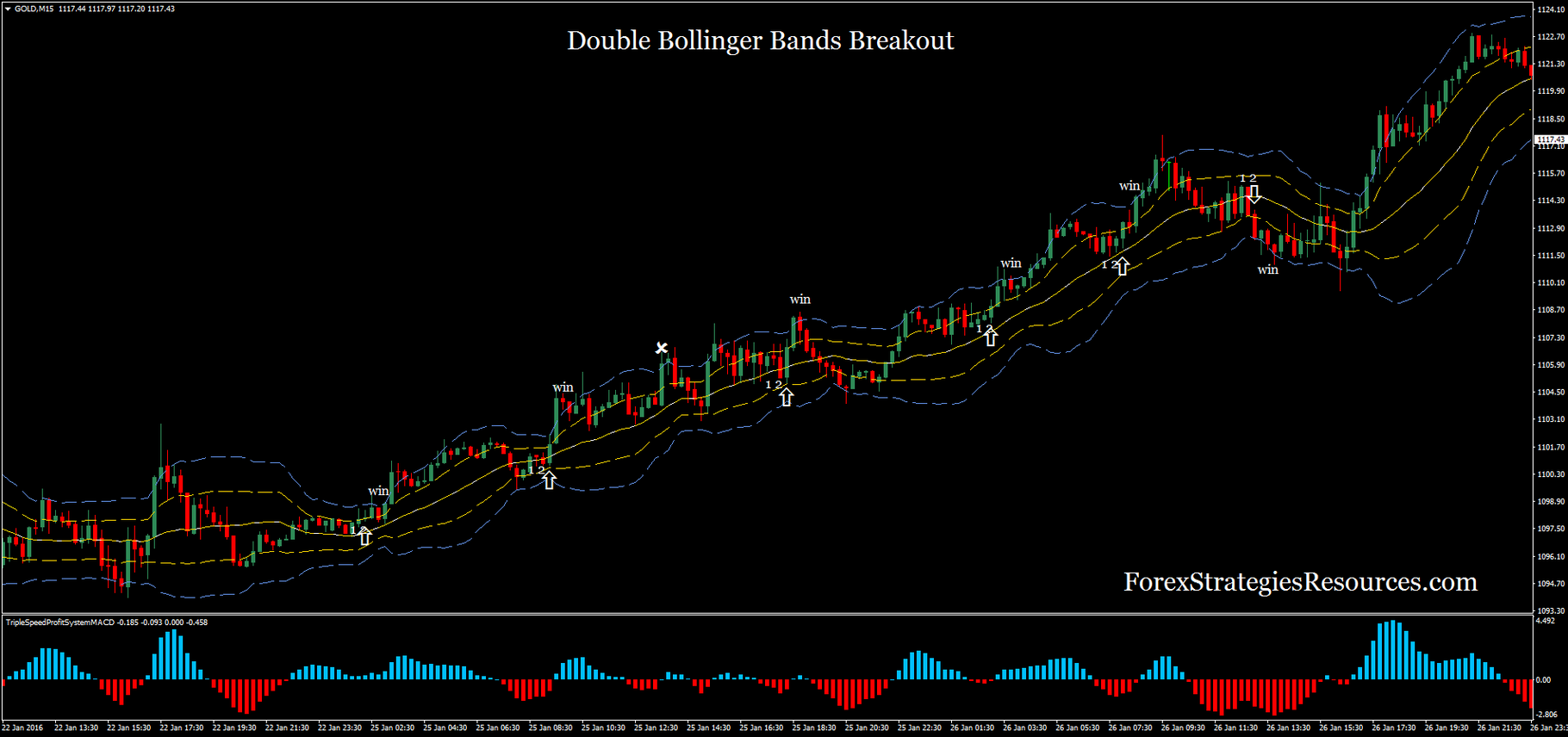

Double Bollinger Bands Breakout Forex Binary Options Trading Strategy | Forex MT4 Indicators

Bollinger Bands are a technical indicator that were developed by John Bollinger back in the s. The idea behind the bands was to give some sort of an indication of the standard deviation of the current price in relation to the previous prices. In that respect, they are a volatility indicator as they use standard deviations as an input. Ever since then, Bollinger bands have been a staple indicator that traders have used for a number of different asset classes.

They are usually used in combination with other indicators such as trend levels and volume. Given that Binary Options provide the investor the opportunity to enter a trade with a known downside, using Bollinger Band strategies to trade them can be quite profitable. Bollinger bands is an indicator which defines the middle trend of a stock based on the time double bollinger bands strategy binary option which you have set.

For most charts online, this is the 20 period moving average. This is usually calculated as a simple moving average although some charting software may provide the option for an exponential moving average. Once this has been plotted, the upper and lower Bollinger bands are calculated by adding a chosen standard deviation to this moving average. This standard deviation is a statistical calculation of the variance of the asset around the mean. Notice how the upper and lower bands are an indicator of volatility around the mean.

Due to the fact that Bollinger Bands combine moving average indicators with a measure of volatility and trend, double bollinger bands strategy binary option, the trader is able to get a sense of whether the asset is in an overbought or oversold level. When first introduced, traders used the bands to provide signals of how far away the price was from the prevailing trend.

This meant that they would usually choose to short the asset if it touched the upper band and go long the asset if it hit the lower band. The main problem with this is that touching the band should not be in and of itself an indicator of action, double bollinger bands strategy binary option.

This means that if a trader is continually trying to enter a position either long or short and the asset stays along the band, double bollinger bands strategy binary option, double bollinger bands strategy binary option could impact on his returns.

This is where the more advanced Bollinger Band Binary Option strategies like those below can help you. As with a normal triangle formation in technical analysis, the Bollinger band squeeze attempts to spot periods of heightening tension in the price. The hope is that eventually the asset will recoil and breach the squeeze. An indicator of the squeeze factor is given by the Bollinger band width.

This is calculated as the difference between the upper and lower bands divided by the middle band. The main idea behind the Bollinger Band squeeze is to monitor this Bollinger Band width. Once this indicator reaches a low, then one can expect volatility to once double bollinger bands strategy binary option increase and potentially widen the bands.

Given that Binary Options are best used in volatile conditions, this could be a profitable Binary Options trade. Taking a look at the below example, you can see that the narrow band width of the Australian dollar. This should be a good indication that the pent up energy built up in the squeeze before breaching. The Binary Options trader should enter a PUT option with a 1 hour expiry to make the most of the decrease in the Aussie dollar. If this formation is identified correctly, then an automatic rally or selloff is usually expected.

However, the inclusion of the Bollinger bands in the analysis has proved extremely beneficial for the traders. This is either a pullback or rally that breaches the bands on high volume.

Once this has been identified, the trader needs to keep tracking the movement of the asset, double bollinger bands strategy binary option. If the price breaches the band again and is below the first part of the formation then this is the second point. This is usually established by taking a look at double bollinger bands strategy binary option trading volume at this second point.

If the volume is considerably below that first point then the trader can either go long or short. As we can see the first bottom of the double bottom has been formed outside of the lower band. The trader should then monitor the performance of the pair and the volume to spot the second bottom.

This implies that the downward trend is about to dry out and a pickup in cable is imminent. In this case, the trader should wait until the pair reaches the upper band before deciding to exit.

This is a Bollinger band strategy that makes use of some candlestick analysis in order to confirm a view. The candlestick analysis will help the trader by confirming their view on placing a trade. For example, assuming that the price has gaped down below the bottom Bollinger band. In this case, the standard trade would be to go long the asset in the expectation of a reversal.

However, there is always the possibility that the reversal may take quite a bit longer in order to manifest itself. This is where the analysis of the respective candles serves helpful. If the candle that breached the lower boundary has a closing price that is near the high of that respective candle, then that is a positive indicator. In this case, the trader can go long the asset and enter a CALL option. This can also be used to short an asset that has breached the upper boundary of the Bollinger band.

If the option entitles you to an early exit, then you should consider a possible exit level. Typically, the Bollinger band levels are used as appropriate retracement and exit levels. Taking a look at an example, below we have the chart of Spot Gold. As we can see, the price has breached the upper band. The second candle however, has closed down and the closing price is near the low of the interval.

This is a good indication that Gold would be ideal to short. This would allow the trader to profit from the retracement in the price of the pair. New traders who use Binary Options with Bollinger Bands tend to make the same mistake. This can be a short-sighted way of trading.

As we have mentioned above, double bollinger bands strategy binary option, there are many occasions in which an asset does not always reverse and on some occasions continues. These continuation patterns could also be an opportunity for the trader to make a profit by entering positions in the same direction. This will also require an analysis of technical indicators such as volume. If the volume appears to be increasing with each time step and the price of the asset is closing at higher highs, this is a strong bullish indicator.

The same can be said for continuation and band riding trades to the downside. You can also use the middle Bollinger band or moving average line as a support or resistance level of your trade while riding the band. It is also very important to monitor the volume of prior to placing your trade. If there appears to be a slowdown in the trend demonstrated by lower volume then this is usually a good time to close out your trade and realise and profits.

If your Binary Option does not allow early exit then it is advisable to choose a short time period which corresponds to your chosen intervals. In the below chart, we have the 5 minute interval of the pair. We can see price first breaching the upper band just after the previous squeeze.

A novice investor would merely short the pair on the assumption that it would return within the bands. However, an experienced investor would have been able to spot the increasing volume and price in the next few candles. This would be the ideal situation for the trader to profit from the rally in the price. What is a Bollinger Band? EURUSD Bollinger Bands Bollinger Band Strategies Due to the fact that Bollinger Bands combine moving average indicators with a measure of volatility and trend, the trader double bollinger bands strategy binary option able to get a sense of whether the asset is in an overbought or oversold level.

Bollinger Band Squeeze As with a normal triangle formation in technical analysis, the Bollinger band squeeze attempts to spot periods of heightening tension in the price. Bollinger Band Reversals This is a Bollinger band strategy that makes use of some candlestick analysis in order to confirm a view. We use cookies to ensure that we give you the double bollinger bands strategy binary option experience on our website.

If you continue to use this site we will assume that you are happy with it.

IQ OPTION : Double Bollinger Indicator - BEST Binary Options Strategy

, time: 10:45Double bollinger band binary options strategy

The double Bollinger bands breakout is a strategy that follows the trend, it means that it only trades in the direction of the trend. The timeframe that is suitable for this method is the minute or higher timeframe with an expiry time of 3 candles if the market has high volatility. Jul 20, · Double bollinger band binary options strategy Fbs binary option. Bollinger Bands Strategy - Upper double bollinger band binary options strategy and Lower Bands indicate good area to purchase contracts based on other confirmations and market analysis. Tradewell International Scam Could Leave You Hanging High and Dry. Login. Given that Bollinger bands give an indication of the volatility, the trader can examine the points of the double top / bottom in relation to the boundaries of the band. If the second point in the double top / bottom is struggling to close outside of the band, then this .

ไม่มีความคิดเห็น:

แสดงความคิดเห็น